how to calculate a stock's price

You can also figure out the average purchase price for each investment by dividing the amount invested by the shares bought at each. Enter the purchase price per share the selling price per share.

2019 Trading Days Calendar Swingtradesystems Com Stock Market Trading Free Calendar Template

Ad Get access to stock charts stock picks more with MarketSmith.

. To do so multiply the share price by the total number of outstanding shares. Finally the user gets the average down the. How To Calculate Stock Price With Formula Using Beta.

The investors will use it to decide whether it will be appropriate to buy or sell the stock based on its current market price or the investor can wait to take his position. A price target estimates the price at which the investors are expected to buy or sell a particular stock. When Benjamin Graham Formula formula is used to Heromoto the Graham number is as follows.

Stock price price-to-earnings ratio earnings per share. Use Zerodha brokerage calculator to calculate the charges you have to pay to execute trade for NSE BSE MCX trades. If you buy the stock at 3 the PE ratio.

In other words we can stay that the Stock Price is calculated as. Find the annualized standard deviation annual volatility of the the SP 500 by multiplying the daily volatility by square root of the number of. Some individuals may recognize this stock price calculation as the beginnings of a discounted cash flow formula.

You should also be able to find that number on the balance sheet. To calculate a stocks value right now we must ensure that the earnings-per-share number we are using represents the most recent four. Divide the total amount invested by the total shares bought.

Dec 6 2021To calculate a stocks market cap you must first calculate the stocks market price. This will give you a price of 667 rounded to the nearest penny. The decision to buy sell or hold is based on whether an investor or investment professional believes that the stock is undervalued overvalued or correctly valued.

Open An Account Today. Graham Number Square root of 1853 x 15 14839 x 184079 2755 Maximum intrinsic value. The price to earnings ratio is another way to figure out how much a stock is worth.

You need to back into the price using the industry ratio as a threshold. For example assume you bought 10. Stock Price 300 105 1 008 10800 108 100.

Enter the commission fees for buying and selling stocks. Computing the future dividend value B DPS A. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

Ad Choose From Hundreds Of No Transaction Fee Mutual Funds. The formula to calculate the target price is. Finding the growth factor A 1 SGR001.

If it is believed to be worth 110 then it is considered undervalued. Based on this Heromotos current share price of 2465 is undervalued when compared to its Graham number of 2755. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate.

Learn how the SP 500 is calculated using a free-float market capitalization-weighted methodology. Small-cap companies for example are those valued between 300 million to 2 billion while between 2 billion and 10 billion are mid-cap. If a stock costs 100 but is believed to be worth 90 then it is overvalued in some peoples view.

Just follow the 5 easy steps below. It does not reflect the actual worth of the stock. The calculation is simple.

Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts. Analyze stocks with our mobile app stock charts more from experts. The most common way to value a stock is to compute the companys price-to-earnings PE ratio.

Enter the number of shares purchased. Ad Dont miss out on opportunities open an account in 10 minutes. These prices will change when the Data Type is.

For example if a corporations total common stockholder equity is 86 million and its average outstanding common stock value is. For more info and latest updates join our Telegram group and channelOur Telegram Channel. This stock average calculator tool added all the shares bought differently divided by the total amount used to buy those stocks.

Start your trial today. The algorithm behind this stock price calculator applies the formulas explained here. The Market Cap aka Market Capitalization reflects the market.

Ad 874 Proven Accuracy. Take the most recent updated value of the firm stock and multiply it by the number of outstanding shares to determine the value of the stocks for traders. How to Calculate Stock Price Based on Market Cap.

Calculate stock returns manually by using the shift method to stack the stock price data so that and share the same index or. In this case that threshold is 10 and earnings per share have been at 1. For example if you brought 100 stocks of company A rate of 10 per stock and bought 200 stocks rate 15 per stock and so on.

Lets now think about why we can calculate it this way. Our 40 Years Of Experience Speaks For Itself. Calculating Todays Stock Prices.

Calculating the Estimated stock purchase price that would be acceptable C B DRR001 SGR001. To find the market price per share of common stock divide the common stockholders equity by the average number of outstanding common stock shares. The first step in calculating gains or losses is to determine the cost basis of the stock which is the price paid plus any associated commissions or fees.

Companies are categorized to where they fall in the market cap spectrum. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. Experience the Power of Artificial Intelligence.

The PE ratio equals the companys stock price divided by its most recently reported earnings per. Assume you purchased the financial services stock with a PE ratio of 3 and now you want to calculate the best price to sell. The value of the SP 500 Index is constantly changing.

To get the current market price of a stock you can use the Stocks Data Type and a simple formula. Essentially the price of a stock is the cash flows gained by the stockholder divided by the discount rate or market capitalization rate. The Stock Calculator is very simple to use.

The result in column C is the current price for each of the stock Data Types in column B. Calculating the Sell Price. Stock Average Calculator helps you to calculate the average share price you paid for a stock.

Of share you want to buy NSB. In the example shown Data Types are in column B and the formula in cell D5 copied down is.

Assessing A Stock S Future With The Price To Earnings Ratio And Peg Stock Futures Peg Being Used

Lookup Historical Stock Split Data For Specific Stocks Starbucks Stock Company Names First Site

What Is The Black Scholes Model Option Pricing Matrix Multiplication Option Trading

Take Small Positions If The Stock S Expensive Investing Value Investing Big Picture

Variance About A Regression Line Technical Writing Infographic Regression

A Bulletproof Answer To A Popular Job Interview Question Https Www Youtube Com Watch V Fcjcdpwqsoo Interview Questions Job Interview Questions Job Interview

Fyers Vs Upstox Find Out Who Is Best In 9 Simple Comparison Points How To Find Out Stock Broker Comparison

Assessing A Stock S Future With The Price To Earnings Ratio And Peg Stock Futures Peg Being Used

New Forecasts Us Stock Market Gann Cycle Decoder Performance Update Indi Us Stock Market Stock Market Forecast

A Beginner S Guide To Stock Investing Stock Futures Investing In Stocks Stock Market

Stock Market Valuation Geometric Mean Economic Trends Standard Deviation

Options Trading Concepts Mike His White Board Youtube Option Trading Swing Trading Trading Strategies

Slide Background Candlestick Patterns Stock Charts Stock Chart Patterns

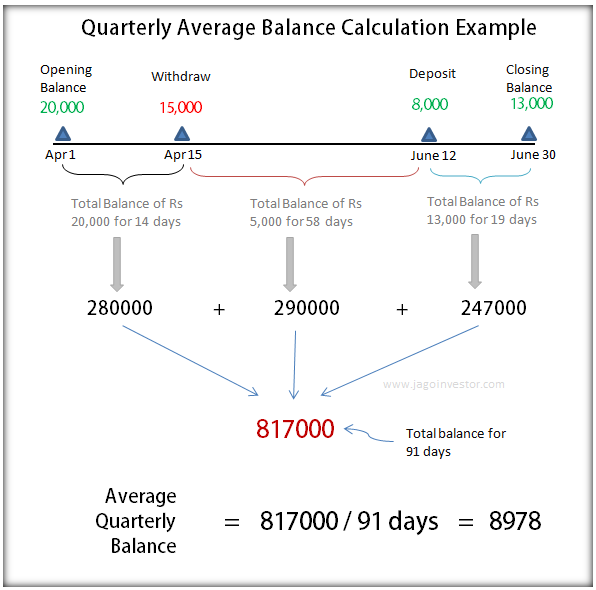

Quarterly Average Balance Meaning Calculation Average Meant To Be Balance

Double Top Pattern Stock Chart Patterns Trading Charts Stock Trading Strategies

The Irs Allows Some Limited Tax Breaks On Medical Expenses And Insurance Premiums Related To Long Term Care In 2022 Elderly Care Long Term Care Human Services

Stock Investment Calculator Calculate Dividend Growth Model Err Investing Online Stock Investing Money